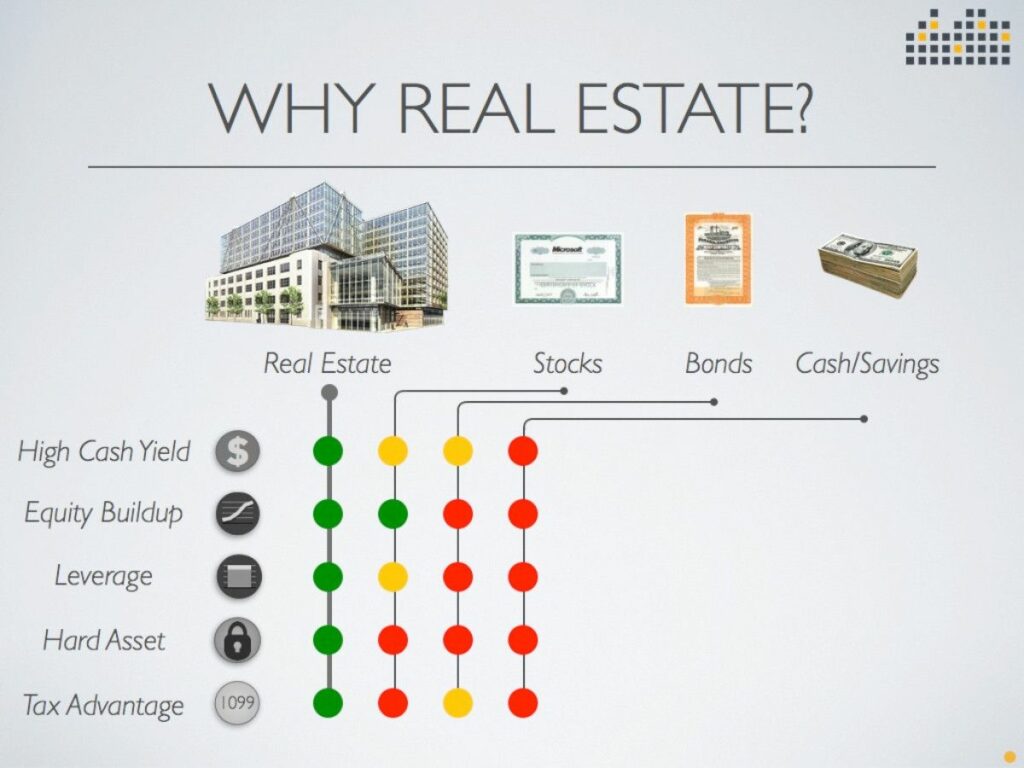

Investing in real estate or investing in stocks is common conundrum for aspiring real estate investors.

It’s much easier to invest in stocks, and the entry point is extremely low. In contrast, investing in real estate is more complicated and requires a larger amount cash on hand. Most people don’t have the luxury of choosing to invest in real estate

But if you can afford to invest in real estate, it’s a better than investing in stocks. Here’s why (and if you need some tips on buying real estate investment property, check out the video below!)

Real Estate Offers Long-Term Returns vs. One Time Payouts:

When you calculate the value of a traditional asset, say a stock or bond, you’re looking at a one-time cash payout. With real estate, you can buy rental properties with positive cash flow and you never have to sell them if you don’t want to. Keep the cash flowing!

Real Estate Cash Flow Creates Immediate Income:

Stocks pay dividends, but few provide over 4% and that’s barely above inflation. It’s true that a stock could rise in value, increasing the value of your investment, but that money is not realized until you sell the stock.

Many real estate investors wouldn’t touch a property if it had 4% annual cash flow. Instead, they want 15-20% or more in cash on cash returns – which makes a meager 4% return look like chump change.

It’s Easy to Become a Local Expert:

You don’t need a degree to become an expert on your local real estate market. You can simply use public information to learn about local home values, area rents, economic conditions and real estate market trends and health. Once you know these indicators, it’s easy to spot a bargain.

Real Estate Is Easy to Value:

Unlike intangible assets which can have somewhat arbitrary valuations, properties are easy to value because they are easy to compare. Even if you have no idea how to value a property, the process is not difficult and there are plenty of people you can ask for help.

By using online calculators, comparing your home to similar homes in the area, evaluating the overall condition of the home, using assessor estimates, you can come up with a fairly accurate ballpark value for your property.

You Can Inspect Real Estate:

When you buy a piece of real estate you can inspect the property before you buy. On the contrary, you can’t possibly inspect all the pieces of a company to affirm it’s stock valuation before you invest.

You have to trust that others have done the legwork for you and that nothing will happen to dramatically impacts the valuation.

You Can Add Value to Real Estate:

Unless you’re in a corporate role for a public company, your opportunities to influence stock value in any relevant way are basically zero. In real estate, however, you have ample opportunity to add value to your assets. Flippers do it all the time by making repairs or rehabbing the property to today’s buyer standards.