|

💰 Low Retirement Taxes and All That Jazz 💰

New Orleans ranks as our No. 1 retirement city because of its affordability. Louisiana doesn’t tax Social Security benefits and has income-level limits on tax rates for 401(k), IRA, and pension distributions.

|

Best Retirement Cities, Ranked | Top 15 Retirement Cities | Best (and Worst) Retirement City Statistics

| 10 Worst Cities to Retire | FAQ

One in three Americans aren’t confident they’ll be able to afford retirement, but a large number of those over 55 are still leaving the workforce.[1] Two million more workers retired during the pandemic than predicted,

and an estimated 50% of adults aged 55 and over left the workforce in the third quarter of 2021 alone.[2]

Although fewer people are moving after retirement, many Americans are trying to decide on their long-term housing plans before leaving the workforce.[3] Issues such as

climate change and increasing costs of living are driving Americans to truly reconsider the best location for them now and in the future.

We found the best cities to retire are those with a high volume and quality of health care options and more affordable premiums for comprehensive health coverage. Due to the lack of universal health care in the country, retirees have to prioritize living

in a state that not only has a quality health care system but also affordable Medicare costs.

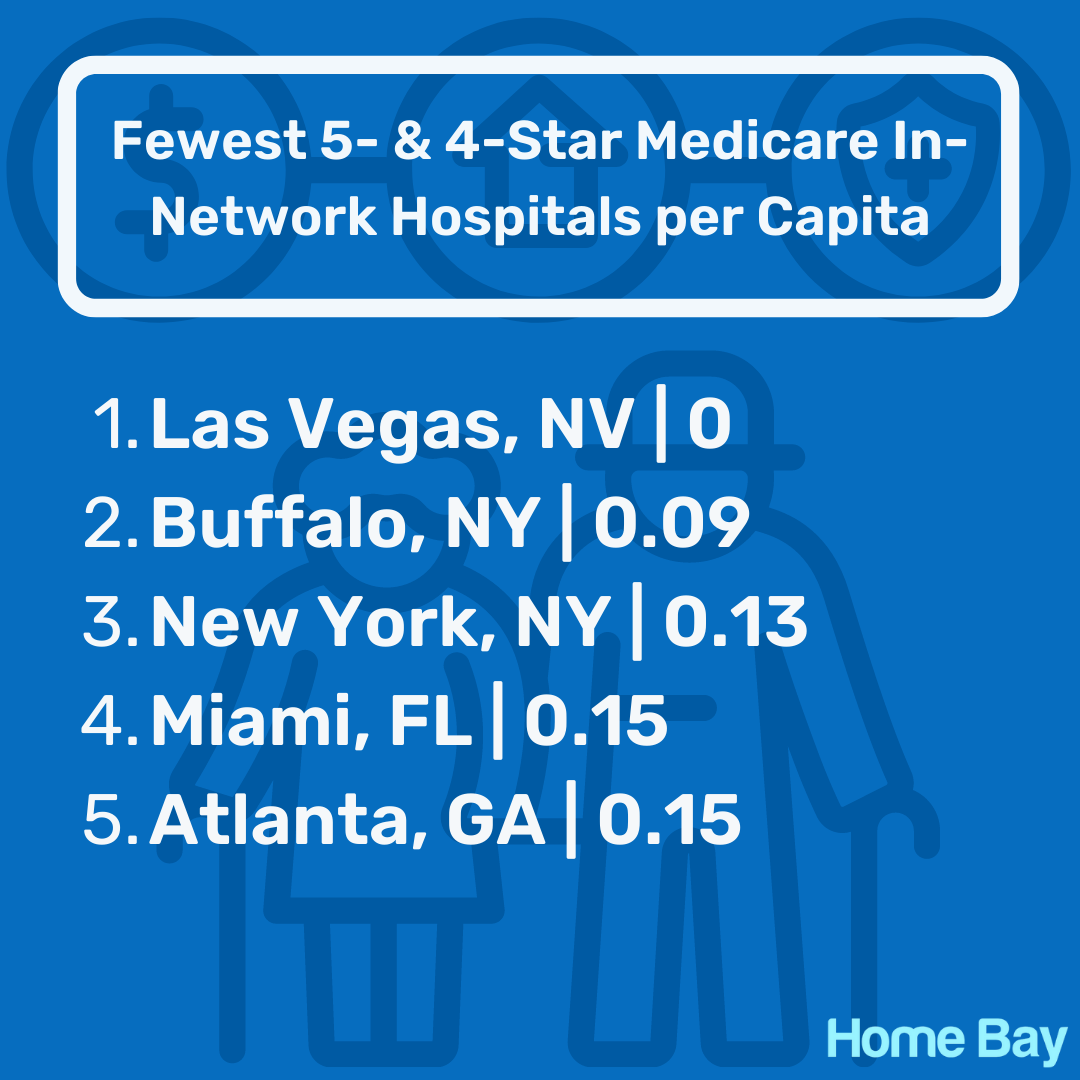

Some metros in our study, such as Las Vegas, really stand out by having zero quality hospitals, defined as having a four-star rating and above on Yelp.

To find the best places to retire, we analyzed data from the Centers for Medicare & Medicaid Services, U.S. Census American Community Survey, U.S. National Centers for Environmental Information, Tax Policy Center, AARP, Zillow, Yelp, Walk Score, and

Numbeo.

We used 18 different metrics — some an aggregate of multiple values — to determine the best cities to retire:

Cost of Living

- 10x: State taxes on 401(k), IRA, pension, and Social Security

- 8x: Estimated median property tax rate (annual percent)

- 6x: State sales tax (percent)

- 4x: Percent increase in single-family home values (2012-2022)

- 4x: Percent increase in condo/co-op values (2012-2022)

- 2x: Monthly cost of internet

- 2x: Monthly cost of basic utilities for a 915-square-foot apartment

- 2x: Cost of a meal for two at a mid-range restaurant

- 2x: Monthly cost of public transit

Health Care

- 10x: Statewide certified Medicare providers per 100,000 state residents

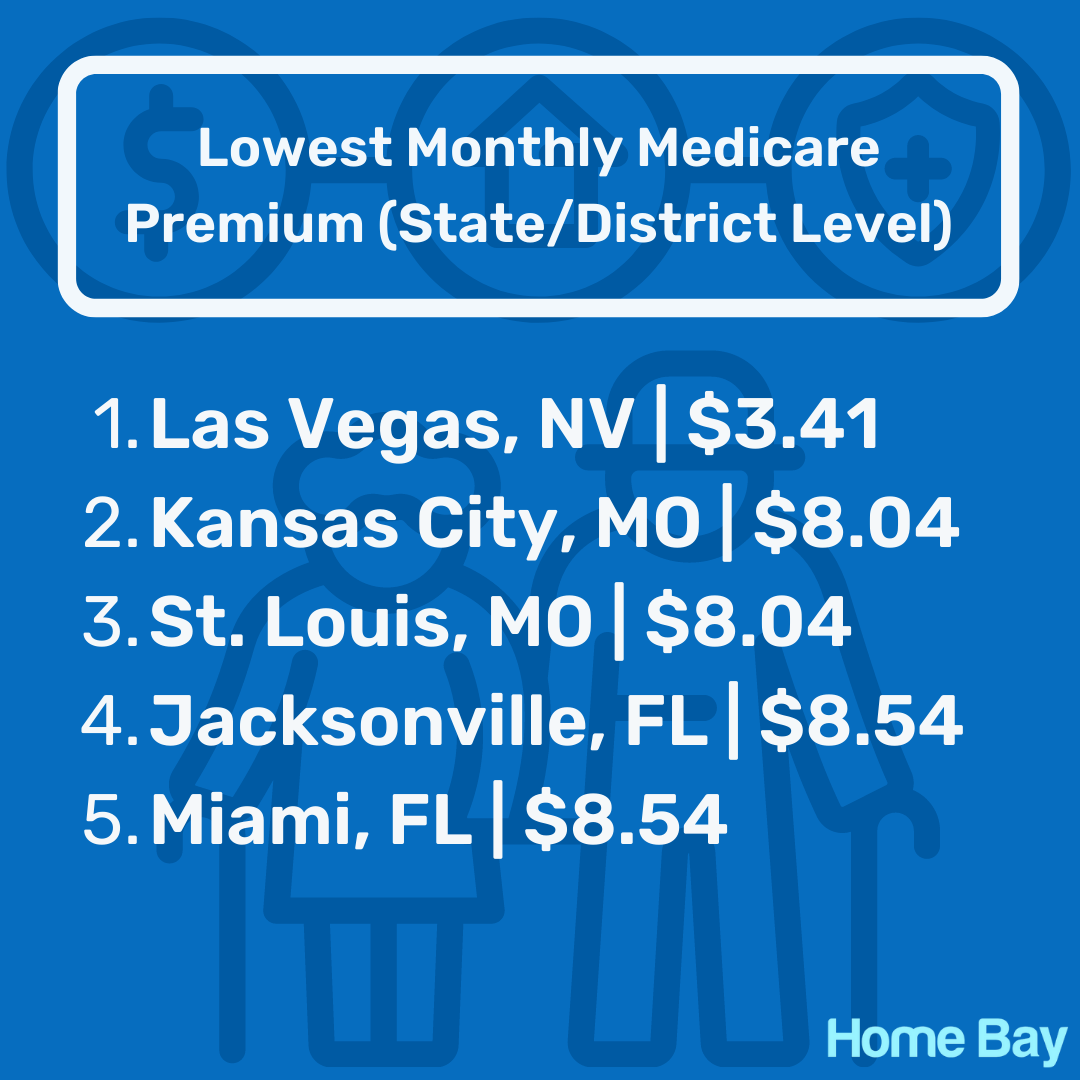

- 10x: Average monthly Medicare Advantage premium (state-level)

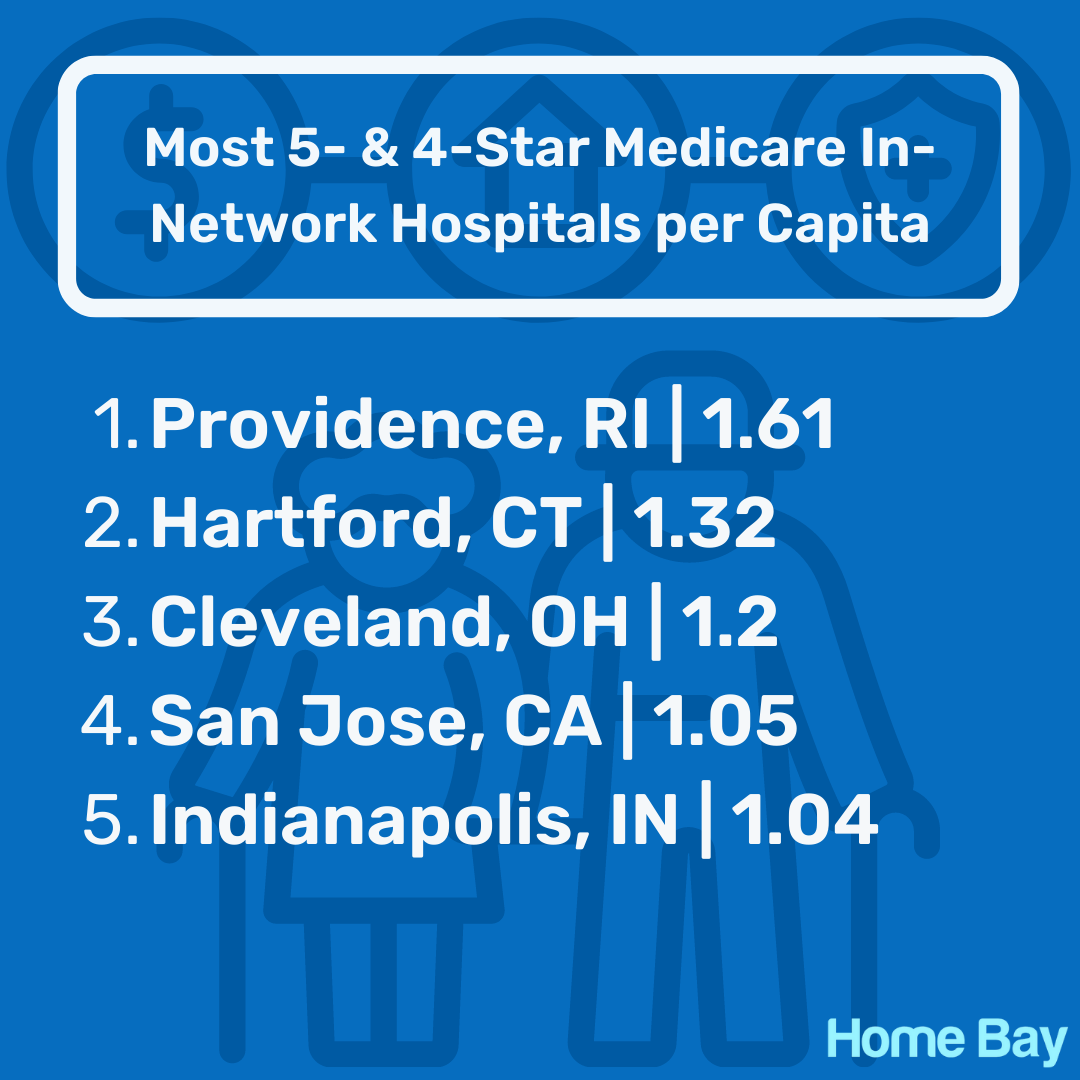

- 8x: Count of five- and four-star hospitals in a 50-mile radius per 100,000 metro residents

- 8x: Lowest monthly premium for a stand-alone Medicare prescription drug plan at the state level

Quality of Life

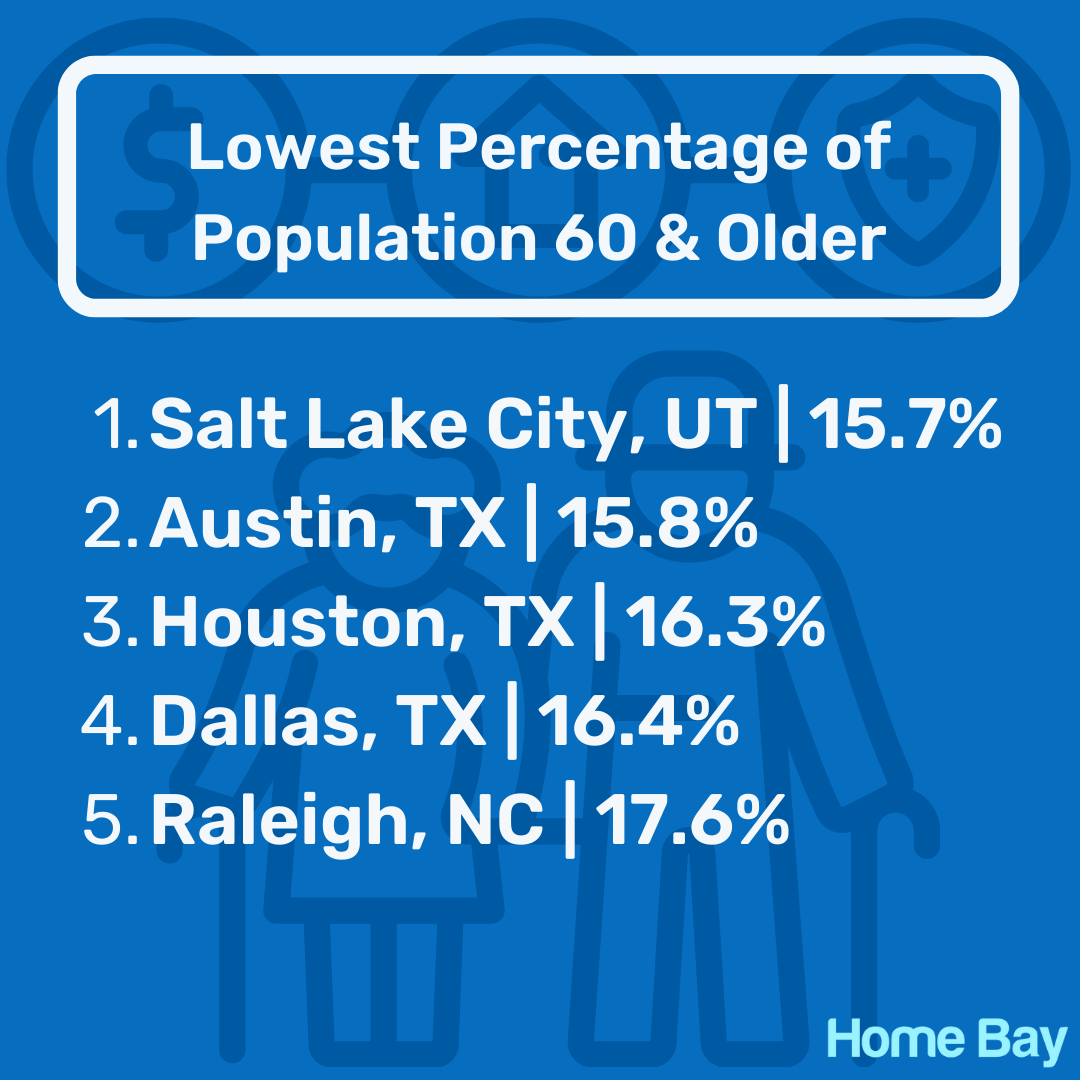

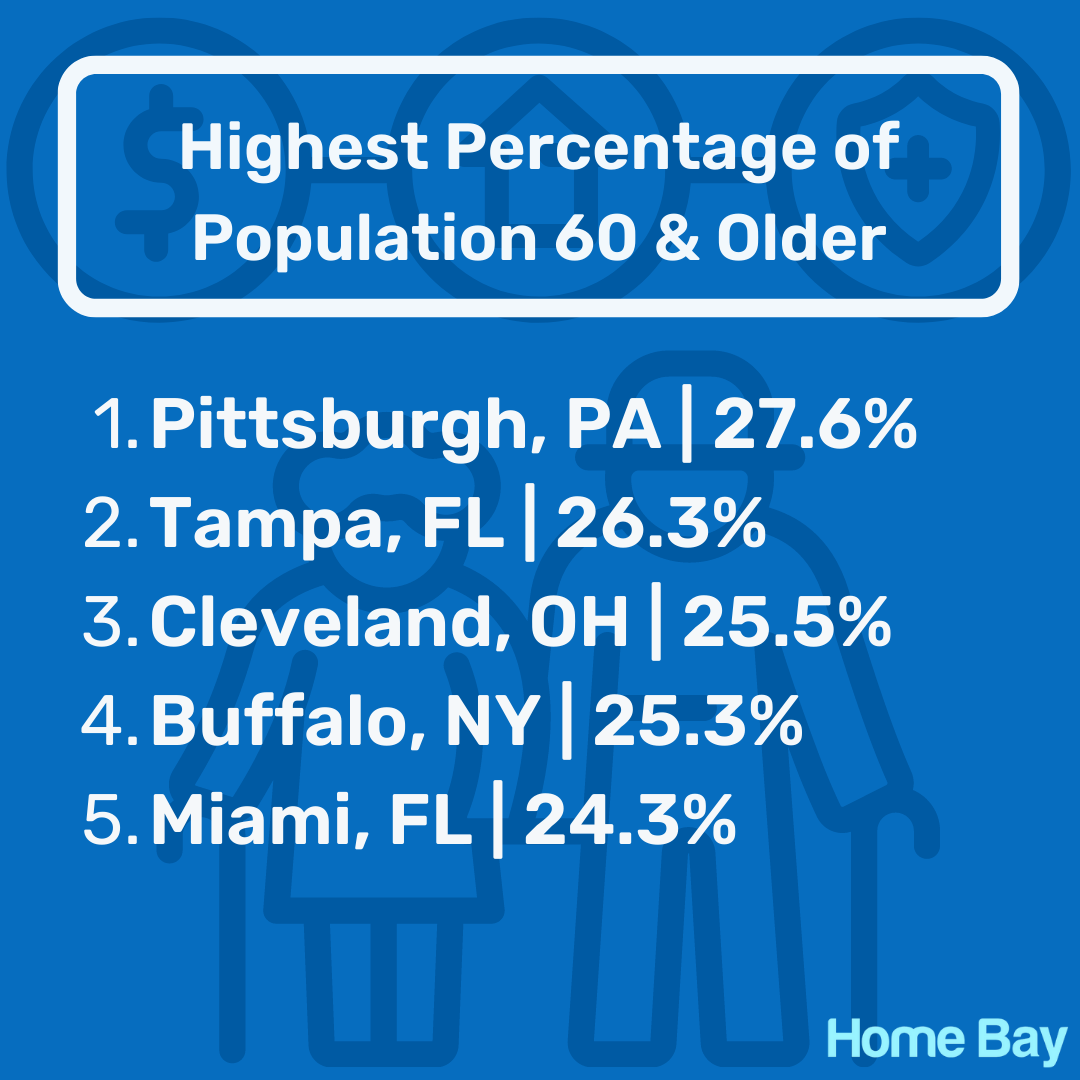

- 10x: Percent of population 60+

- 8x: Walkability score

- 6x: Recreation score

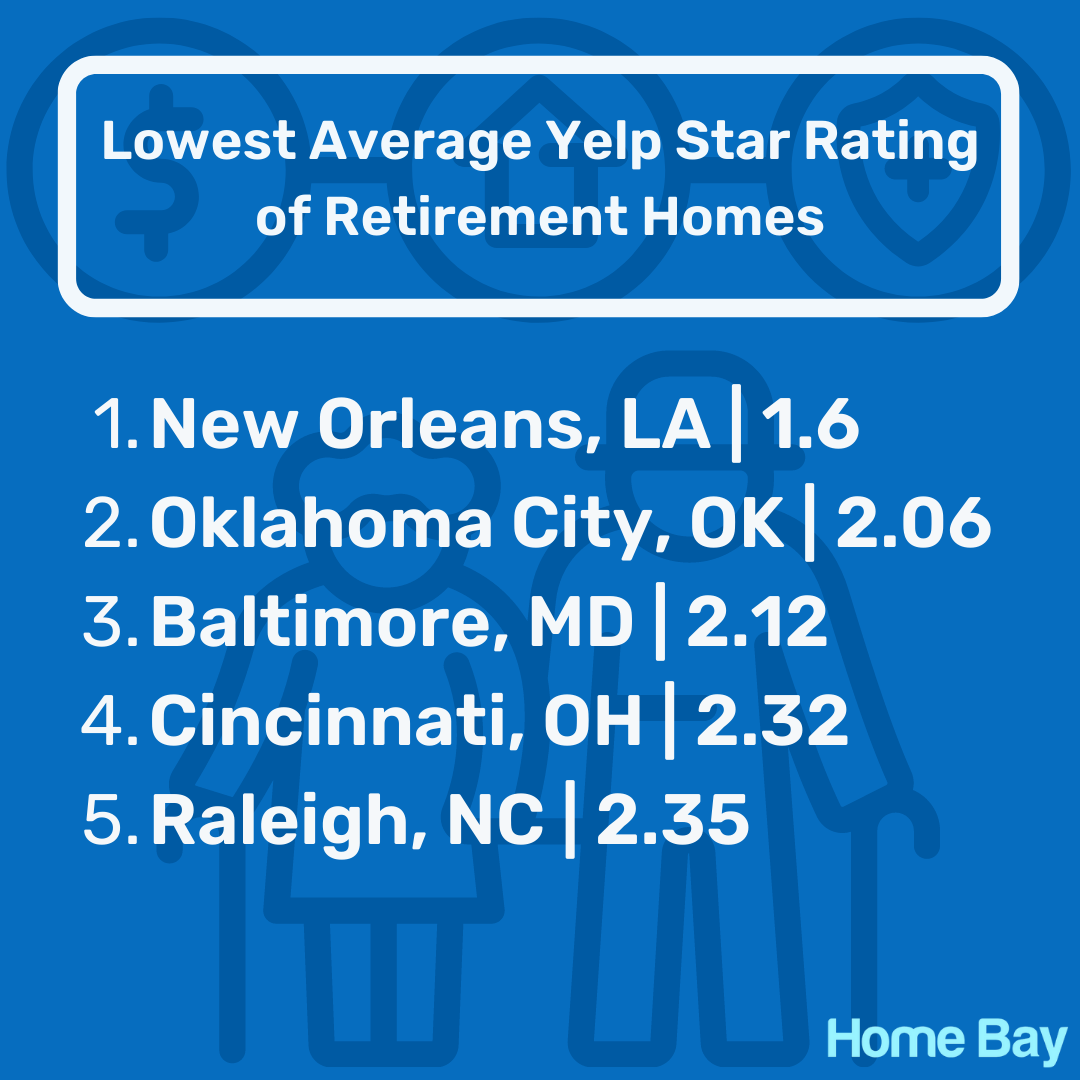

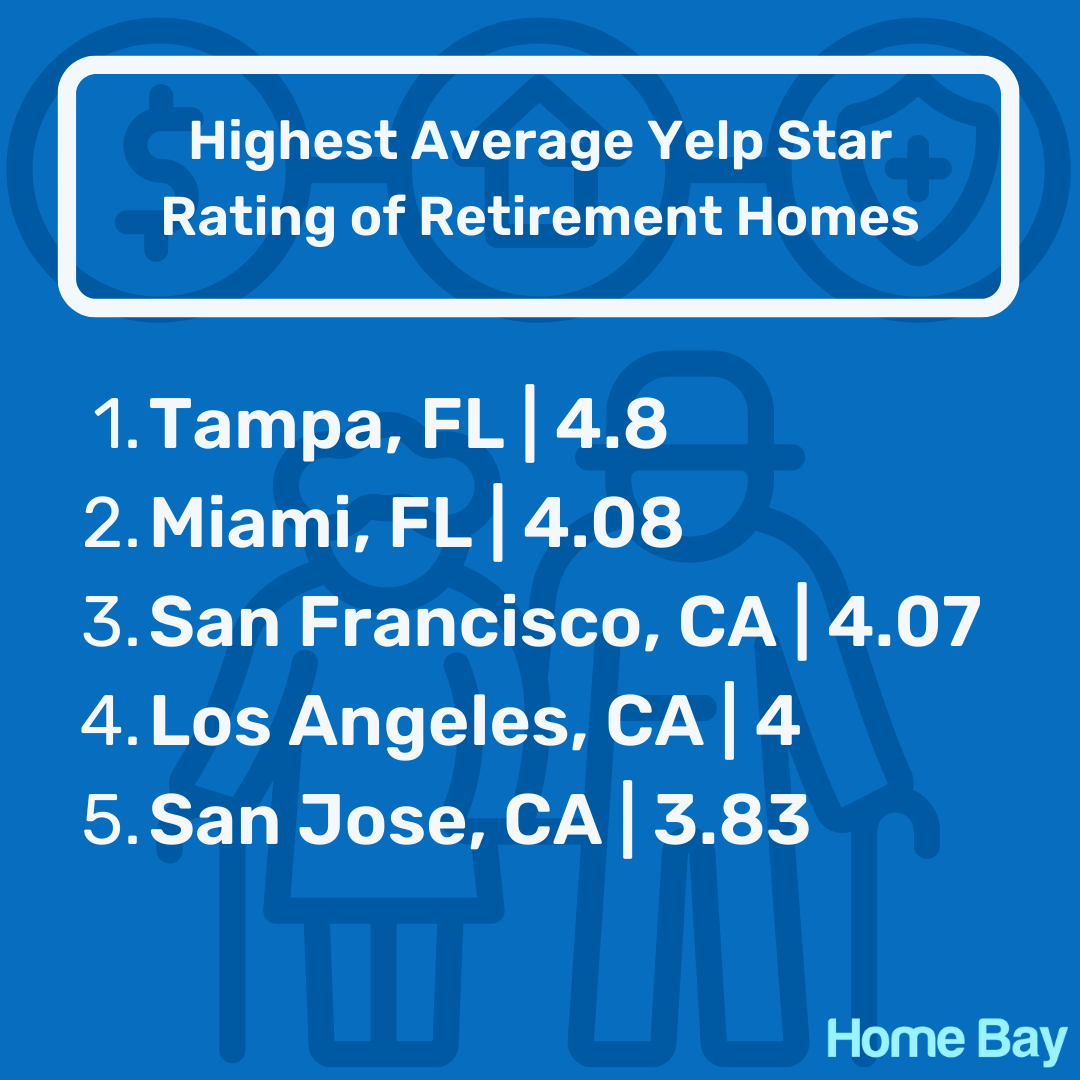

- 6x: Average Yelp star rating of retirement homes in the metro

- 4x: Seasonal weather score

👵 Retirement Cities Statistics 👴

|

The 50 Best Cities to Retire, Ranked

|

Rank |

City |

Overall Score |

% Population 60+ Years Old |

Seasonal Weather Score |

Avg. Yelp Rating of Retirement Homes |

% Increase in Single Family Home Values (2012-2022) |

Estimated Property Tax Rate |

Recreation Score |

Avg. State Medicare Advantage Premium |

Quality Hospitals per 100K Residents* |

|

– |

National Average |

– |

20.9 |

64.1 |

3.11 |

126.2% |

1.2% |

77.3 |

$20.30 |

0.51 |

|

1 |

New Orleans, LA |

100 |

22.7% |

63.4 |

1.6 |

58% |

0.69% |

100 |

$14.53 |

0.71 |

|

2 |

Birmingham, AL |

94.36 |

22.5% |

61.1 |

3.36 |

78.7% |

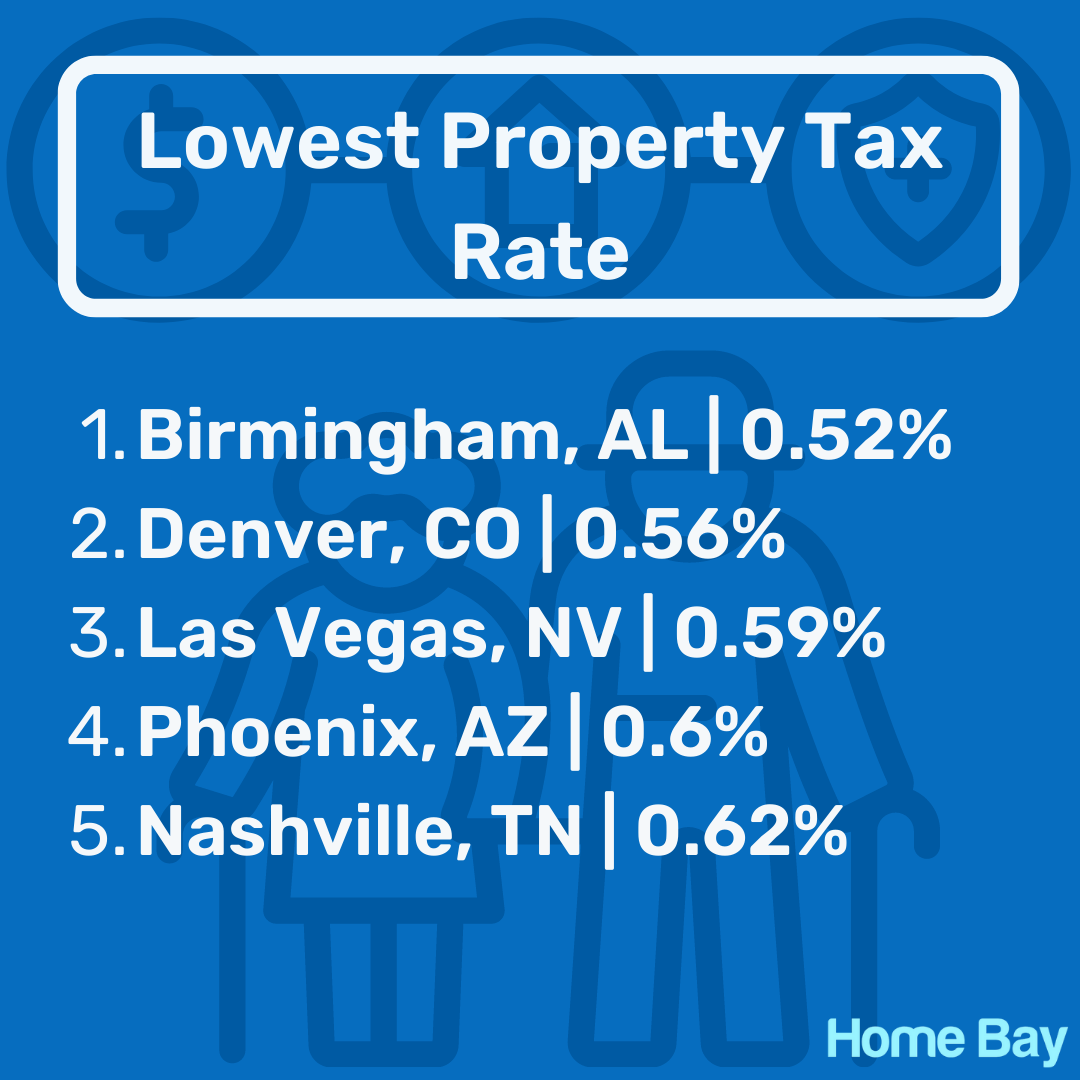

0.52% |

74.3 |

$11.21 |

0.27 |

|

3 |

Louisville, KY |

93.91 |

22.5% |

57.4 |

3.63 |

80.5% |

0.9% |

88.6 |

$14.02 |

0.39 |

|

4 |

St. Louis, MO |

92.24 |

23.5% |

54.5 |

2.68 |

70.8% |

1.35% |

71.9 |

$8.04 |

0.82 |

|

5 |

Denver, CO |

91.73 |

18.5% |

63.2 |

3.28 |

167.6% |

0.56% |

81.6 |

$14.11 |

0.67 |

|

6 |

Richmond, VA |

91.49 |

21.9% |

61 |

3.33 |

74.2% |

0.79% |

78.7 |

$16.15 |

0.61 |

|

7 |

Tampa, FL |

91.47 |

26.3% |

71.5 |

4.8 |

217% |

0.89% |

73.6 |

$8.54 |

0.5 |

|

8 |

Oklahoma City, OK |

90.38 |

19.6% |

56.7 |

2.06 |

68.2% |

1.1% |

76.3 |

$13.66 |

0.49 |

|

9 |

Miami, FL |

89.06 |

24.3% |

74.2 |

4.08 |

178.8% |

0.99% |

70.3 |

$8.54 |

0.15 |

|

10 |

Nashville, TN |

88.76 |

19% |

59 |

3.79 |

165.6% |

0.62% |

72.5 |

$18.74 |

0.5 |

|

11 |

Indianapolis, IN |

88.7 |

19.5% |

59 |

3.1 |

107.7% |

0.92% |

74.9 |

$14.86 |

1.04 |

|

12 |

Milwaukee, WI |

88.69 |

22% |

60.7 |

2.64 |

85.1% |

1.75% |

75.9 |

$29.87 |

1.02 |

|

13 |

Kansas City, MO |

88.21 |

20.9% |

53.1 |

2.94 |

105.3% |

1.23% |

73.2 |

$8.04 |

0.87 |

|

14 |

Providence, RI |

88.11 |

24.0% |

63.9 |

2.86 |

92.6% |

1.45% |

77.1 |

$25.46 |

1.61 |

|

15 |

Pittsburgh, PA |

88.04 |

27.6% |

63.9 |

3.06 |

72.4% |

1.66% |

75.9 |

$32.79 |

0.63 |

|

16 |

Memphis, TN |

87.89 |

20.1% |

56.8 |

2.5 |

100.7% |

1.05% |

73.8 |

$18.74 |

0.15 |

|

17 |

Hartford, CT |

86.99 |

24.2% |

61.6 |

2.89 |

46.3% |

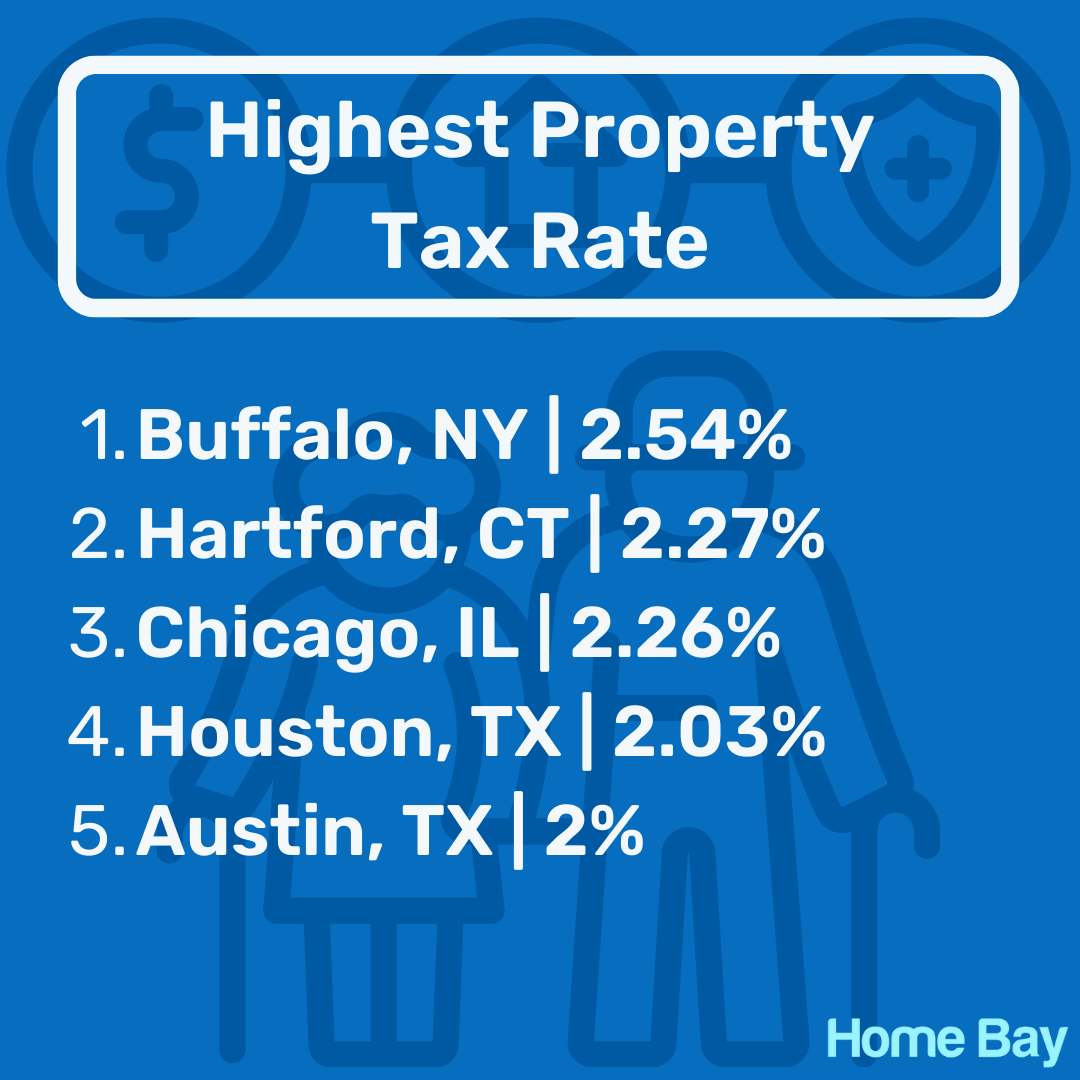

2.27% |

78.2 |

$19.95 |

1.32 |

|

18 |

Jacksonville, FL |

86.25 |

22% |

66.2 |

3.13 |

160.8% |

0.9% |

79.9 |

$8.54 |

0.37 |

|

19 |

Virginia Beach, VA |

86.07 |

20.9% |

61.2 |

3.16 |

52.2% |

0.9% |

73.5 |

$16.15 |

0.39 |

|

20 |

Chicago, IL |

86.01 |

20.6% |

56.8 |

3.23 |

73.9% |

2.26% |

70.4 |

$12.83 |

0.34 |

|

21 |

Cleveland, OH |

85.93 |

25.5% |

61.9 |

3 |

82.5% |

1.98% |

74.4 |

$18.75 |

1.2 |

|

22 |

Cincinnati, OH |

85.49 |

21.7% |

62.8 |

2.32 |

92.5% |

1.43% |

79 |

$18.75 |

0.89 |

|

23 |

Philadelphia, PA |

85.15 |

22.6% |

59.1 |

2.68 |

62.1% |

1.73% |

69.4 |

$32.79 |

0.4 |

|

24 |

Orlando, FL |

84.69 |

20.4% |

70.5 |

3.42 |

190.8% |

0.87% |

75.1 |

$8.54 |

0.22 |

|

25 |

Baltimore, MD |

84.03 |

22% |

60.1 |

2.12 |

48.8% |

1.09% |

75.5 |

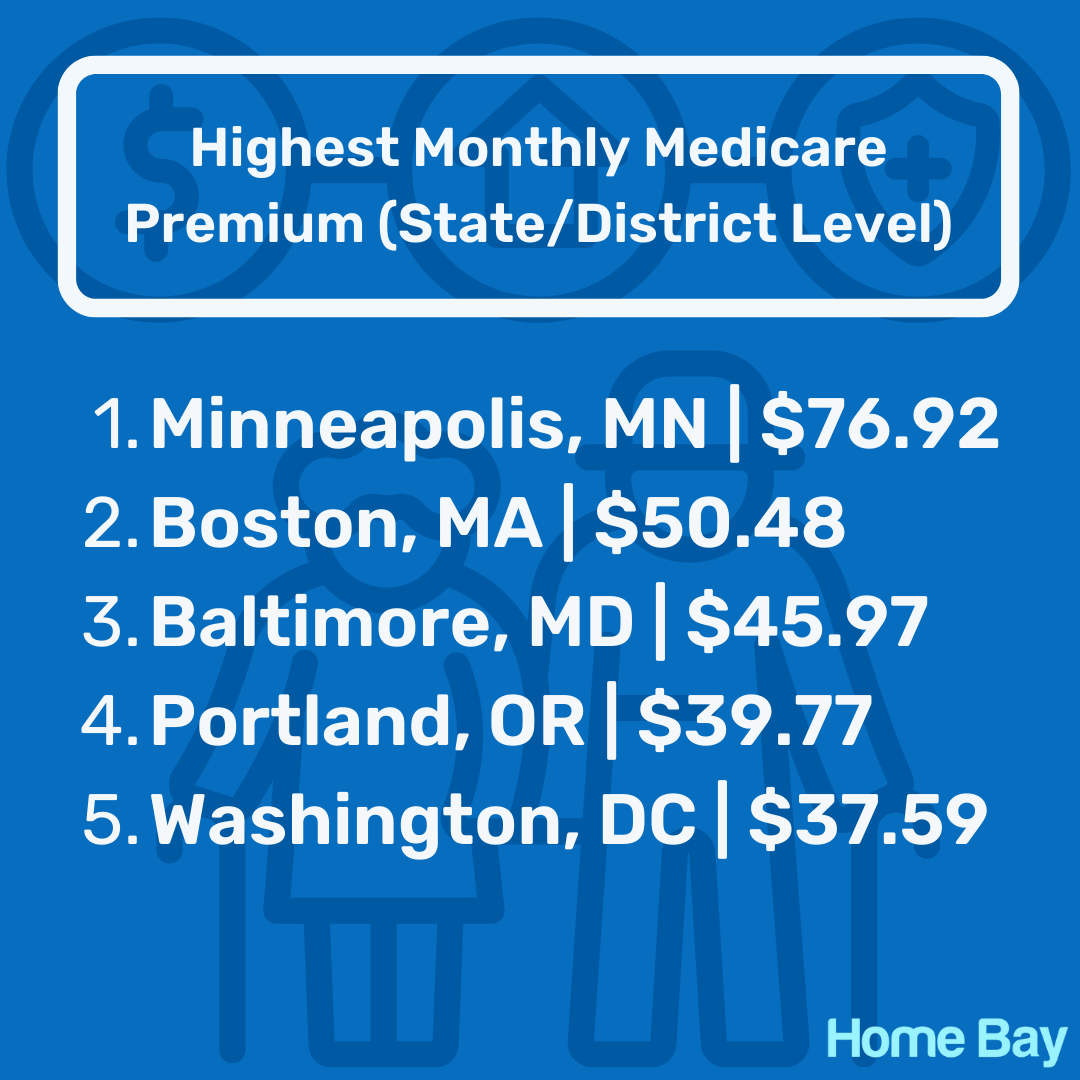

$45.97 |

0.6 |

|

26 |

San Francisco, CA |

83.24 |

21.5% |

100 |

4.07 |

176.8% |

0.81% |

96.9 |

$18.12 |

0.46 |

|

27 |

Austin, TX |

82.75 |

15.8% |

58.6 |

3.79 |

189.9% |

2% |

88.6 |

$10.68 |

0.43 |

|

28 |

San Antonio, TX |

82.69 |

18.3% |

60 |

2.86 |

111.0% |

1.98% |

73.8 |

$10.68 |

0.16 |

|

29 |

Houston, TX |

82.66 |

16.3% |

61.9 |

2.83 |

111.7% |

2.03% |

65.5 |

$10.68 |

0.24 |

|

30 |

Portland, OR |

81.82 |

21% |

82.4 |

3.62 |

149.8% |

0.97% |

89.3 |

$39.77 |

0.56 |

|

31 |

Atlanta, GA |

80.88 |

17.8% |

62.7 |

3.04 |

183.8% |

0.97% |

69.6 |

$13.55 |

0.15 |

|

32 |

Washington, DC |

80.87 |

18.7% |

57.7 |

3.17 |

65.6% |

1% |

73.6 |

$37.59 |

0.28 |

|

33 |

San Jose, CA |

80.84 |

18.9% |

84.5 |

3.83 |

168.2% |

0.82% |

97.9 |

$18.12 |

1.05 |

|

34 |

Raleigh, NC |

80 |

17.6% |

61.4 |

2.35 |

129.4% |

0.83% |

79.3 |

$15.22 |

0.28 |

|

35 |

Las Vegas, NV |

79.31 |

20.3% |

45.9 |

3 |

240.5% |

0.59% |

92.4 |

$3.41 |

0 |

|

36 |

Charlotte, NC |

79.16 |

19.3% |

62.2 |

3.07 |

151.4% |

0.82% |

68.8 |

$15.22 |

0.34 |

|

37 |

Dallas, TX |

79.13 |

16.4% |

55 |

3.39 |

167.9% |

1.94% |

65.9 |

$10.68 |

0.34 |

|

38 |

Los Angeles, CA |

78.8 |

19.6% |

89.6 |

4 |

138.8% |

0.77% |

74 |

$18.12 |

0.26 |

|

39 |

New York, NY |

78.78 |

21.9% |

61.2 |

3.13 |

65% |

1.88% |

70.3 |

$30.20 |

0.13 |

|

40 |

Columbus, OH |

78.45 |

19% |

60.4 |

2.63 |

115% |

1.67% |

77 |

$18.75 |

0.56 |

|

41 |

Salt Lake City, UT |

77.99 |

15.7% |

55.3 |

2.95 |

187.7% |

0.64% |

77.2 |

$17.71 |

0.79 |

|

42 |

Boston, MA |

77.77 |

21.9% |

64.4 |

2.47 |

95.2% |

1.24% |

70.9 |

$50.48 |

0.55 |

|

43 |

Buffalo, NY |

77.21 |

25.3% |

64.1 |

3.29 |

96% |

2.54% |

88.5 |

$30.20 |

0.09 |

|

44 |

Phoenix, AZ |

77.04 |

21.2% |

46.7 |

3.02 |

220.7% |

0.6% |

70.5 |

$11.64 |

0.25 |

|

45 |

San Diego, CA |

76.5 |

19.7% |

88 |

3.69 |

158.8% |

0.8% |

87.2 |

$18.12 |

0.27 |

|

46 |

Seattle, WA |

76.43 |

19.3% |

83.4 |

3.41 |

199.4% |

0.96% |

81.3 |

$34.45 |

0.27 |

|

47 |

Detroit, MI |

75.11 |

23.2% |

60.3 |

2.38 |

165.2% |

1.52% |

67.8 |

$28.74 |

0.3 |

|

48 |

Sacramento, CA |

73.77 |

21.6% |

71.4 |

3.66 |

185.5% |

0.88% |

81.1 |

$18.12 |

0.46 |

|

49 |

Riverside, CA |

73.17 |

18.4% |

73.7 |

3.67 |

197.7% |

0.91% |

70.3 |

$18.12 |

0.48 |

|

50 |

Minneapolis, MN |

71.26 |

20% |

53.4 |

2.7 |

104.3% |

1.16% |

71.3 |

$76.92 |

0.68 |

|

*The star rating is given to each hospital by the Centers for Medicare and Medicaid Services based on how well a hospital performs across various categories of quality, such as treating pneumonia and heart attacks, readmission rates, and general safety |

||||||||||

The 15 Best Cities

|

🥇 Hope Is Out There 🥇

Housing prices are rising everywhere, but the top 15 metros have seen smaller increases than in other cities, meaning it would likely be easier for retirees to purchase in these metros.

|

The top 15 cities not only have a higher volume and quality of health care options compared to other metros in our study, but they also have more affordable premiums for comprehensive health coverage. They’re more tax-friendly and affordable, too.

- Medicare affordability: The top 15 metros have an average monthly Medicare premium of $15.90 at the state level. That’s 22% cheaper than the average city in our study ($20.30).

- Lower taxes: The average estimated property tax is 1% for the top 15 metros. Compared to 1.2% in the average city in our study, that’s a 15% difference.

- Homeownership perks: The typical value of single-family homes in the top 15 cities has increased an average of 108.2% from 2012-2022. Compared to 126.2% in the average city in our study, that’s a 14% smaller increase.

When compared to rising home values in the bottom 10 cities (161.1%), increases in the top 15 metros are about 33% lower.Condos are also cheaper in our top 15 metros. The typical value for condos and co-ops in the top 15 cities has increased an average of 94.3%. That’s a 19% smaller increase than the average city in our study (116.1%).

1. New Orleans, Louisiana

|

🐊 Move Over, Gator The cost of single-family housing has grown at a smaller rate in New Orleans (58%) than in the average city (126%), making it a great option for retirees looking for housing that’s affordable. |

It will come as no surprise that New Orleans’ rich culture is one of the main draws for retirees. New Orleans earned a perfect recreation score of 100, which is 29% higher than the average metro in our study.

Another perk of living in New Orleans as a retiree is that Louisiana doesn’t tax Social Security and has income-level limits on tax rates for 401(k), individual retirement account (IRA), and pension distributions. New Orleans also has an estimated

annual property tax rate of only 0.7%. That’s a 43% lower property tax rate on your future home compared to 1.2% in the average city in our study.

New Orleans is also located in a state that has 130.4 certified Medicare providers per 100,000 state residents. Compared to the average metro in our study (101.2), that’s 29% more per capita.

2. Birmingham, Alabama

|

👬 In Good Company Birmingham is a great choice if you’re looking for a retirement community. Nearly 23% of the population in Birmingham is 60 years or older — 7.8% higher than the average city in our study. |

Our No. 2 city also has affordability going for it. It has only experienced a 78.7% increase in single-family home values since 2012, which is 38% smaller than the increase in the average metro in our study (126.2%).

If condos or co-ops are more your speed, Birmingham has also seen a 71.9% surge in values — a rise that’s 39% smaller than the average metro increase (16.1%).

As part of Alabama, Birmingham’s estimated monthly Medicare premium is $11.21. Compared to the monthly state premium for the average metro ($20.30), that’s 45% lower.

3. Louisville, Kentucky

|

🌟 A Glowing Review Retirement homes in Louisville have a 17% higher average star rating on Yelp (3.6) than the average city (3.1). |

Louisville is another metro great for retirees who are seeking a community. About 22.5% of the population is 60 years or older. It also has a recreation score of 88.6 out of 100, which is 17% higher than average. That’s great news

if you’re also looking for plenty to do after retirement!

As for the cost of living, Louisville has an estimated annual property tax rate of 0.9%, compared to 1.2% in the average city in our study. If you need to get around, a monthly public transit pass is only $35, 52% cheaper than the monthly cost in the

average metro ($72.36).

Internet in Louisville is also slightly cheaper than other metros at $62.27 a month, compared to the average of $68.77. This can make a big difference year over year, especially if you plan on dedicating your retirement years to a hobby such as online

gaming.[4]

4. St. Louis, Missouri

|

💰 Big Savings St. Louis’ average monthly Medicare premium is just $8.04 — 60% lower than the average metro. |

If quality health care is a major priority for you, St. Louis has 0.82 five- and four-star Medicare-provider hospitals per 100,000 residents in a 50-mile radius. Compared to the average metro in our study (0.51), that’s 60% more per capita.

Overall, St. Louis is an incredible choice if you’re prioritizing affordability. St. Louis has also experienced only a 70.8% increase in single-family home values since 2012, which is a 44% smaller increase than average.

Condos in the city have seen an even smaller increase at just 60.9% compared to the average increase of 116.1%.

5. Denver, Colorado

|

⛰ So Much to Explore! Denver has a 5.6% higher recreation score (81.6) than the average city (77.3). It’s known for a wide variety of professional sports teams, such as the Broncos and Nuggets, but it’s also home to one of the country’s highest-rated botanical |

Denver has a 14% higher walkability score (61 out of 100) than the average city (53.5), which is convenient given how much there is to do around the city.

Retirement homes in Denver also rate fairly well on Yelp (3.3) compared to the average metro (3.1). This is good news if you value recreation but want the community and dedicated care of a retirement home.

If you’re looking for more solitude, you’ll be pleased to learn that Denver’s estimated annual property tax rate of 0.6% is 54% lower than the average metro (1.2%).

You can also take advantage of the lower state sales tax rate of 2.9% in Denver. That’s 49% lower than the average metro (5.7%).

6. Richmond, Virginia

|

💏 Virginia Is for Homeowners Home values in Richmond have increased just 74.3% since 2012, a rise that’s 41% smaller than in the average metro (126.2%). |

Richmond has also seen a lower-than-average increase in condo and co-op home values (64.4%) during the same time period, so it’s a more affordable place to purchase a home, no matter your preference.

What’s more, Richmond has a competitive estimated annual property tax rate of 0.79%, which is 34% lower than average (1.2%).

Retirees in Richmond will also save quite a bit on monthly utilities. For a 915-square-foot apartment in Richmond, expect to pay about $155.49 in utilities. That’s 11% lower than the monthly cost in the average metro ($175.56).

7. Tampa, Florida

|

🌴 A Preceding Reputation Florida is known as a haven for retirees, so it’s no surprise that retirement homes in Tampa have a 54% higher average star rating on Yelp (4.8). |

More than one-fourth of the population in Tampa (27%) is 60 years or older – 26% higher than average. This is not surprising, as Florida is one of the most popular states for folks from out of state to retire.

While part of Florida’s allure is the year-round great weather, it’s also an affordable place to live compared to many other states! Tampa has an estimated annual property tax rate of just 0.9% compared to 1.2% in the average city.

Tampa is also in a state where the average monthly Medicare premium is $8.54 — 58% lower than average.

>> LEARN MORE: Best Places to Retire in Florida

8. Oklahoma City, Oklahoma

|

🏡 Housing Deals Oklahoma City is another metro in our top 15 that boasts more affordable housing than average. It experienced a 68.2% increase in single-family home values since 2012, 46% smaller than the increase the average metro in our study experienced. |

Oklahoma City has also experienced just a 65.2% increase in condo and co-op home values since 2012 — 44% smaller than average.

It’s located in a state that has 125.8 certified Medicare providers per 100,000 residents. Compared to the average metro in our study (101.2), that’s 24% more per capita.

The average monthly Medicare premium in Oklahoma is also just $13.66, 33% lower than the monthly state premium for the average metro ($20.30).

9. Miami, Florida

|

🏖 For Those Who Like to Party Retirement doesn’t mean you have to put your dancing shoes away. Although Miami is known for its lush nightlife, 24.3% of the population is over the age of 60. That’s a 16% higher population of residents over 60 than average. |

Miami also boasts a 44% higher

walkability score (77 out of 100) than the average city. This is great news for retirees who want to stay active, enjoy the outdoors, and revel in the sunny weather Florida is known for.

Like Tampa, Miami has a competitive annual property tax rate, at 0.99% compared to 1.2% in the average city in our study. That’s 18% lower than average.

Affordable utilities are another financial draw for Miami. A 915-square-foot apartment in the city has an average monthly bill of $134.93, 23% lower than the monthly cost in the average metro.

>> LEARN MORE:

Best Places to Retire in Florida

10. Nashville, Tennessee

|

🏆 A Cut Above Retirement homes in Nashville have a 22% higher average star rating on Yelp (3.8) than the average city (3.1). |

Coupled with quality retirement homes and a great music scene, Nashville’s affordable public transportation also really raises its allure for retirees who still want to get out and about but need some support. In Nashville, a monthly public transit

pass is $67.50 — 6.7% cheaper than average.

Access to quality health care is extremely important in retirement years, so it’s advantageous that Nashville is located in a state that has 115.2 certified Medicare providers per 100,000 residents. Compared to the average metro in our study, that’s

14% more per capita.

For retirees who really need access to affordable prescription drugs, it’s important to know that Tennessee’s lowest monthly premium for a standalone Medicare prescription drug plan is $6.50. That’s 8.5% lower than the monthly state premium

in the average metro ($7.10).

>> LEARN MORE: Best Places to Retire in Tennessee

11. Indianapolis, Indiana

|

🚍 Railroad City’s Got Buses, Too! The cost of a monthly public transit pass in Indianapolis is just $42.50. Compared to the monthly cost in the average metro, that’s 41% cheaper. Although it doesn’t have any public transit train lines, the city’s bus system includes 3,385 |

In the housing market, condo prices in Indianapolis have fared well over the years. Indianapolis has seen just a 94.3% increase in condo and co-op home values over the past 10 years, which is 19% smaller than the average increase.

Indianapolis also has a relatively low estimated annual property tax rate of 0.9% — 24% lower than average. Coupled with its lower housing prices, this is a great city to consider for one’s future retirement.

12. Milwaukee, Wisconsin

|

🏃 More Like Milwalkee Milwaukee has a 16% higher walkability score (62 out of 100) than the average city, which is great for retirees who are also cicerones and would enjoy exploring the city’s breweries by foot. |

Milwaukee is also an affordable place to live. It has experienced just an 85.1% increase in single-family home values since 2012, 33% smaller than the average increase.

The increase in condo and co-op values is even lower at just 71%. That’s 39% smaller than the average metro.

In addition to breweries, Milwaukee is a great choice for foodies as well. The average cost of a meal for two at a mid-range restaurant is just $50. That’s 28% less expensive than the cost in the average metro ($68.98).

13. Kansas City, Missouri

|

🏥 Another Great Choice for Affordable Health Care Kansas City’s, average monthly Medicare premium is $8.04. Compared to the monthly state premium for the average metro, that’s 60% lower. |

Kansas City is a great option for those with a tight retirement budget. It has experienced a 105.3% increase in single-family home values in the past 10 years — 17% smaller than the average increase.

KC has also experienced just a 74.3% increase in condo and co-op home values, 36% less than the average rise. Condos are a great option for those who don’t want the responsibility of a front- and backyard in their retirement

years.

Getting around in Kansas City is also cheaper than average. The cost of a monthly public transit pass is just $50, 31% cheaper than the monthly cost in the average metro.

14. Providence, Rhode Island

|

👣 Perfect Setting Providence has a 42% higher walkability score than the average city (53.5). This is great for exploring the city’s oceanside views comfortably. |

Retirees will be in good company on their daily strolls. Nearly one-fourth of the population in Providence (24%) is 60 years or older. That’s 15% higher than the average city in our study.

Providence is another town with significantly more affordable technology services. The monthly cost of internet is just $60.67 — 12% lower than average.

The cost of a monthly public transit pass in Providence is also significantly cheaper at $40 — 45% cheaper than average.

15. Pittsburgh, Pennsylvania

|

👴 A Warm Community Pittsburgh is another surprising hot spot for retirees, with 27.6% of the population in Steel City aged 60 years or older — 32% higher than the average city in our study. This is a great option for retirees who love big cities on the East Coast. |

Although northern East Coast states have a reputation for being expensive, Pittsburgh’s home values have fared fairly well compared to other metros over the years. Pittsburgh has experienced a 72.4% increase in single-family home values in the past

10 years — 43% less than the average nationwide increase.

As for its condo and co-op market, these types of homes have seen an even smaller increase — 55% — which is 53% less than average. It’s excellent for retirees who want to stay in the urban center.

Pittsburgh also provides retirees with access to affordable health care. The metro has 0.63 five- and four-star Medicare-provider hospitals in a 50-mile radius per 100,000 residents. Compared to the average metro in our study, that’s 24% more per

capita.

Data Details: Top 5 Rankings by Category

|

|

|

|

|

|

|

|

|

|

|

|

|

| *We determined a city’s recreation score by ranking each city for each activity or type of recreation based on the number of locations per capita and the average Yelp star rating. Then we combined those normalized scores to determine the overall recreation score out of 100. A low recreation score means the metro has fewer recreation facilities (golf courses, art galleries, etc.) and lower quality (lower star ratings) than other metros. | |

10 Worst Retirement Cities

Although each metro in our study has something for every retiree, some just didn’t fare as well as others in our analysis. These may be the “worst” retirement cities, but there were truly no bad cities to retire in discovered

through our research. These were the 10 lowest-scoring cities for retirees:

- Minneapolis, Minnesota

- Riverside, California

- Sacramento, California

- Detroit, Michigan

- Seattle, Washington

- San Diego, California

- Phoenix, Arizona

- Buffalo, New York

- Boston, Massachusetts

- Salt Lake City, Utah

Overall, the bottom 10 have a higher cost of living compared to other metros.

- Expensive housing markets: The typical value of single-family homes in the bottom 10 cities has increased an average of 161.1%. Compared to 126.2% in the average city in our study, that’s a 28% increase. The typical

value for condos and co-ops in the bottom 10 cities has increased an average of 159.7% — 38% more than the average city in our study. - High sales taxes: The average state sales tax across the bottom 10 metros is 6.3%. Compared to the average for all metros in our study (5.7%), that’s a 10% higher sales tax rate.

- Higher utilities: The average cost of basic utilities for a 915-square-foot apartment in the bottom 10 cities is $72.30 — a 4.8% higher price than all other metros.

- Pricey public transportation: The average cost of a monthly public transit pass in the bottom cities is $77.40 — a 7% higher price than all other metros.

Our bottom city, Minneapolis, has a few things going for it — such as a great walkability score (71) and modest increases in typical home values (104.3% since 2012) compared to other cities — but it’s still struggling with higher Medicare

premiums, lower ratings for hospitals, public transit costs, higher taxes, and lower recreation scores.

Namely, the average Medicare monthly premium at the state level is $76.92, which is 279% more expensive than the average metro in our study ($20.30). Minneapolis also has a 20% higher

state sales tax rate (6.8%) than the average city (5.7%).

|

🤑 You Should Know About Filial Responsibility Laws 🤑

Did you know that in 26 states plus Puerto Rico, there are filial responsibility laws that leave children

on the hook for the care of their parents who are seniors? It’s true! And we won’t judge if these laws influence where you want to settle down… |

Metros in States That Don’t Tax Retirement Distributions

Want to maximize your retirement savings? These metros are located in states that don’t tax 401(k), IRA, or pension distributions, per the AARP:

- Jacksonville, Florida

- Miami, Florida

- Orlando, Florida

- Tampa, Florida

- Chicago, Illinois

- Las Vegas, Nevada

- Philadelphia, Pennsylvania

- Pittsburgh, Pennsylvania

- Memphis, Tennessee

- Nashville, Tennessee

- Austin, Texas

- Dallas, Texas

- Houston, Texas

- San Antonio, Texas

- Seattle, Washington

Metros in States That Tax Retirement Distributions With No Income Limits

Retiree beware! These metros are in states that do tax 401(k), IRA, and pension distributions and have no income-level limitations on that tax rate, per the AARP:

- Los Angeles, California

- Riverside, California

- Sacramento, California

- San Diego, California

- San Francisco, California

- San Jose, California

- Washington, D.C.

- Minneapolis, Minnesota

- Charlotte, North Carolina

- Raleigh, North Carolina

- Cincinnati, Ohio

- Cleveland, Ohio

- Columbus, Ohio

- Portland, Oregon

- Salt Lake City, Utah

Methodology

Home Bay compared the 50 most-populous U.S. metro areas across several metrics, listed below. Each metric was normalized and then graded on a 100-point scale. The combined weighted average of the scores determined the “retirement city” score

upon which the final ranking was based. Data points were attributed to metropolitan areas as much as possible. For some data points, statewide data was used. For others, regional data was used.

The metrics used are as follows:

- Percent of the metro area population that is 60 years and older (18.52%)

- Taxes on 401(k), IRA, pension, and Social Security payouts (18.52%)

- Number of statewide certified Medicare providers per 100,000 state residents (18.52%)

- Average monthly Medicare Advantage premium at the state level (18.52%)

- Count of five- and four-star Medicare in-network hospitals in a 50-mile radius per 100,000 residents (14.81%)*

- Lowest monthly premium for a stand-alone Medicare prescription drug plan at the state level (14.81%)

- Estimated median annual property tax rate (14.81%)

- Walkability score (14.81%)

- State sales tax percentage (11.11%)

- Average Yelp star rating of retirement homes in the metro (11.11%)

- Normalized score of recreational activities based on the number of options per capita and average star rating on Yelp (11.11%)

- Seasonal weather score based on highest average winter temperatures and lowest average summer temperatures for each metro (7.41%)

- Percent increase in typical single-family home values (2012-2022) (7.41%)

- Percent increase in typical condo/co-op values (2012-2022) (7.41%)

- Monthly cost of internet (3.7%)

- Monthly cost of basic utilities for a 915-square-foot apartment (3.7%)

- Cost of a meal for two at a mid-range restaurant (3.7%)

- Cost of a monthly public transit pass (3.7%)

Sources: Centers for Medicare & Medicaid Services, U.S. Census American Community Survey, U.S. National Centers for Environmental Information, Tax Policy Center, AARP, Zillow, Yelp, Walkscore, and Numbeo.

*The star rating is given to each hospital by the Centers for Medicare and Medicaid Services based on how well a hospital performs across various categories of quality, such as treating pneumonia and heart attacks, readmission rates, and general safety

of the care they administer.

About Home Bay

Where your real estate voyage begins. Since 2014, Home Bay has helped thousands of readers confidently sail through their next home sale or purchase. In 2021, Home Bay was acquired by Clever Real Estate, a free agent-matching service that has helped consumers

save more than $82 million on real estate fees. Research by Home Bay’s Data Center has been cited by The New York Times, CNBC, MarketWatch, NPR, Apartment Therapy, Yahoo Finance, Black Enterprise, and more.

More Research from Home Bay

Other Articles from Home Bay

Frequently Asked Questions

We determined that the best five cities to retire in are:

- New Orleans, Louisiana

- Birmingham, Alabama

- Louisville, Kentucky

- St. Louis, Missouri

- Denver, Colorado

Find out what makes these cities so great for retirement!

Happiness, although subjective, can be tied to the things we do for fun. In our study, we gave cities a “recreation score” to determine which had the most and widest variety of things to do for fun! Our top five cities for recreation are:

- New Orleans, Louisiana

- San Jose, California

- San Francisco, California

- Las Vegas, Nevada

- Portland, Oregon

Find out which cities had the lowest recreation scores.

Based on their affordable housing prices, transit prices, and Medicare premiums, Birmingham, Alabama; Louisville, Kentucky; and Oklahoma City are the “cheapest” cities to retire in the United States.

Learn more about what makes these cities so affordable for retirees!